Participating in the 401(k) Retirement Plan is one of the best things you can do to save for your future.

Why you should join

How to enroll

How to save

Matching contributions

How matching contributions are vested

How to select your investment options

Your investment options

How to roll-in a 401(k) or IRA

How to take a loan

Why you should join

- Free money from Intuit through eligible* matching contributions—$1.25 for every $1 you contribute, up to 6% of your eligible annual pay for a maximum $10,000 per year

- A clear view of how much monthly income you will need in retirement

- Flexible saving opportunities through pretax, Roth, or after-tax contributions from your base salary and/or bonus; also, in-plan Roth conversion for even more expanded options

- Access to experienced retirement services professionals—via phone, email or chat—to help get you on the right track to reach your retirement goals

How to enroll

Learn how to enroll in the 401(k) plan.

As a new hire (or re-hire), you'll be automatically enrolled in the 401(k) plan with a standard contribution of 6%. Contributions will be invested in the Vanguard Target Retirement Trust Plus Fund that most closely matches your anticipated retirement year at age 65. You can change this contribution or opt out at any time. You can also request to withdraw automatic contributions made to your account within 90 calendar days after the first automatic contribution is first taken from your pay. To change your participation in the Plan, including opting out, visit the Empower website or call Empower at 844-INTU401.

If you do not opt out of the plan or make an active election, your automatic contributions will automatically increase 1% each year on August 1 to help you reach your retirement goals.

How to save

You have three ways to contribute to the 401(k) plan—pretax, Roth and after-tax:

Pretax contributions

| Contributions | Deducted from your paycheck before taxes are withheld, reducing current taxable income |

| Limits* | Up to 50% of your eligible compensation, subject to the IRS limit ($23,000 in 2024). If you are age 50 or older in 2024, you can contribute an additional $7,500. |

| Withdrawals | Subject to income tax |

Roth contributions

| Contributions | Deducted from your paycheck after taxes are withheld |

| Limits* | Up to 50% of your eligible compensation, or the IRS limit ($23,000 in 2024). If you are age 50 or older in 2024, you can contribute an additional $7,500. |

| Withdrawals | Tax-free† |

After-tax contributions

| Contributions | Deducted from your paycheck after taxes are withheld |

| Limits** | Up to 50% of your eligible compensation, or the plan limit ($36,000 in 2024) |

| Withdrawals | Contributions are tax-free; earnings are subject to income tax |

* Contribution limits refer to the combined total of pretax and Roth contributions.

** The after-tax limit includes the combined total of pretax, Roth and employer matching contributions.

† Earnings are tax-free upon withdrawal if you own the Roth 401(k) account for at least five years and have reached age 59½.

Matching contributions

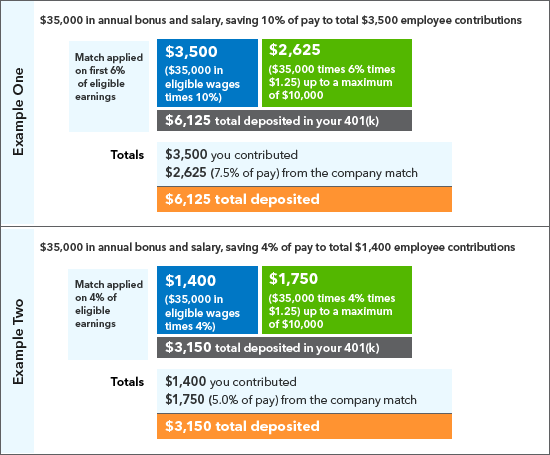

For each $1 you contribute to your 401(k) account, Intuit will contribute $1.25, up to 6% of eligible annual pay to a maximum $10,000 per year. If you’re not already saving 6%, you’re missing out on a valuable part of how Intuit helps you build financial security.

Here's an example of how it works.

Green: Intuit’s contribution

Blue: Your contribution

Orange: The total contribution toward your retirement

Note: If you change your savings percentage during the year, your year-to-date contributions and pay will be used to determine your match. Also, matching contributions will not be made on regular after-tax contributions or catch-up contributions.

Roth in-plan conversions

In-Plan Roth conversions give employees the opportunity to convert pretax and/or after-tax (non-Roth) deferrals to Roth money within the Intuit 401(k) plan. Taxes may be owed upon conversion, but future qualified distributions will be tax-free. Only vested money is eligible to be converted.

Call Empower Retirement at 844-INTU401 (844-468-8401) for more information and instructions.

How matching contributions are vested

Vesting is a term used to describe how much of Intuit’s matching contributions you "own." It’s the percentage of the match that you could take with you when you change jobs or retire, and it's based on your years of service. You always own 100% of your own contributions. Matching contributions are 100% vested immediately.

How to select your investment options

The way you invest your 401(k) account is completely up to you—not just your contributions, but also Intuit’s matching contributions and any amount that you roll over from another account. Learn more about how to choose 401(k) investment options.

Your investment options

Here are the Intuit 401(k) plan investment options:

Target funds

Each of these funds is diversified based on your retirement date, professionally managed, and adjusted over time to maintain the appropriate risk and return as you get closer to your retirement date.

The “target date” of these funds is your expected retirement date, assuming you’ll retire at age 65. For example, if you expect to retire in or around 2045, you could choose the Vanguard Target 2045 Fund.

| Target funds | Expense ratio | Asset class |

| Vanguard Target 2060 | 0.06% | Asset Allocation |

| Vanguard Target 2055 | 0.06% | Asset Allocation |

| Vanguard Target 2050 | 0.06% | Asset Allocation |

| Vanguard Target 2045 | 0.06% | Asset Allocation |

| Vanguard Target 2040 | 0.06% | Asset Allocation |

| Vanguard Target 2035 | 0.06% | Asset Allocation |

| Vanguard Target 2030 | 0.06% | Asset Allocation |

| Vanguard Target 2025 | 0.06% | Asset Allocation |

| Vanguard Target 2020 | 0.06% | Asset Allocation |

| Vanguard Target 2015 | 0.06% | Asset Allocation |

| Vanguard Target Retirement | 0.06% | Asset Allocation |

Core funds

| Core funds | Expense ratio | Asset class |

| Putnam Stable Value | 0.15% | Capital Preservation |

| State Street Global All Cap Equity ex-US Index Securities Lending Class II | 0.06% | International Funds |

| State Street Russell Small Cap Index L Class II | 0.03% | Small Cap Funds |

| State Street S&P Midcap Index Securities Lending Class XIV | 0.02% | Large Cap Funds |

| State Street S&P 500 Index Securities Lending Class II | 0.01% | Large Cap Funds |

| State Street US Bond Index Securities Lending Class XIV | 0.02% | Bond |

| Vanguard FTSE Social Index I Fund | 0.12% | Large Cap Funds |

Self-directed brokerage

The Plan also offers a self-directed brokerage option that lets you invest in a wide variety of investments beyond the ones available within the Plan. Investments through the brokerage option are not selected by Intuit or its partners. This option is generally intended for more experienced investors who have the time and knowledge to manage a more sophisticated portfolio.

To use the brokerage option, you must have a minimum balance of $1,000 in the core plan.

The brokerage account is offered through Charles Schwab for an annual fee of $50. To open a brokerage account, call 844-INTU401 and speak to an Intuit 401(k) Plan Participant Service Representative.

How to roll-in a 401(k) or IRA

Learn how to roll money from a previous employer into the Intuit 401(k).

How to take a loan

Learn how to borrow from your account.